High risk personal loan brokers

Choose a secured personal loan. Secured personal loans on the other hand are backed by collateral.

How To Get A Personal Loan Forbes Advisor Forbes Advisor

If you wait a month or two you could end up with a higher interest rate on that debt -- and higher monthly.

. Population in 2020 was 188 years. This means that those who retire at the traditional age should. I wouldnt want to buy high-risk investments and take the chance of losing the borrowed money entirely and lower-risk ones likely would simply not produce enough to pay the interest on the loan.

New cars arent cheap and unless you have a pile of cash sitting around youll probably need to finance your vehicle. Personal loan A personal loan is a loan which can be taken to meet unspecified financial needs. Corporate unsecured debt Since this type of debt assumes a greater amount of risk corporations that have lower bond ratings such as BBB are classified as unsecured debt due to their higher default risk.

A secured personal loan is a loan thats secured by an asset such a car which is used as collateral for the money borrowed. People who bought cars at the end of 2020 borrowed an average of 35228 for. The process can secure a lower overall interest rate to the.

Depending on which kind of personal loan you getfrom a bank via peer-to-peer P2P lending or by some other meanssome lenders will be more favorably disposed to your paying off the loan. A personal loan is an amount of money you can borrow to use for a variety of purposes. The interest rate of a personal loan is the percentage of the loan principal that lenders charge for borrowers to access the loan funds.

Debt consolidation is a form of debt refinancing that entails taking out one loan to pay off many others. With the SP 500 at record highs and interest rates at record lows uncovering medium-risk investments for high returns is a challenge. The Cyclically Adjusted Price Earnings ratio or CAPE is at.

Thats why its important to move quickly if youre interested in a personal loan. This commonly refers to a personal finance process of individuals addressing high consumer debt but occasionally it can also refer to a countrys fiscal approach to consolidate corporate debt or government debt. For instance you may use a personal loan to consolidate debt pay for home renovations or plan a dream wedding.

Secured loans often have lower interest rates than unsecured loans as lenders consider them to be less of a risk. On average personal loan interest rates range from 10 to. Most personal loans are unsecured meaning they dont require collateral like your house or car.

To get started with your comparison its worth figuring out what type of personal loan may fit your needs. Today personal loan segment has. The Centers for Disease Control and Prevention reports that life expectancy at age 65 for the US.

10 Best And Easiest Loans To Get Approved For In Australia 2022 In 2022 Easy Loans Same Day Loans Loans For Bad Credit

Everything You Need To Know About Low Income Personal Loans Forbes Advisor

Pin On Consumer Financing

Mortgage Broker Vs Big Bank Who Should I Choose Mortgage Brokers Loans For Bad Credit Mortgage

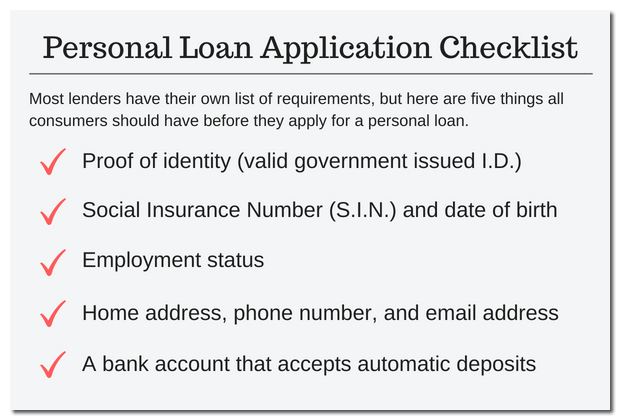

How To Qualify For A Personal Loan Loans Canada

Best Personal Loan Rates For September 2022 Nextadvisor With Time

Personal Loans Up To 50 000 In Canada Fairstone

No Guarantor Loans For Bad Credit No Fees No Broker No Credit Loans Loans For Bad Credit Best Payday Loans

Personal Business Loans The Pros And Cons Of Loans Visual Ly Business Loans Business Person Small Business Loans

Best Bad Credit Loans In Canada 2022 Secured Unsecured

Personal Loans

Best Personal Loans Of September 2022 Forbes Advisor

Mortgage Bad Credit In North Vancouver Fha Mortgage Bad Credit Personal Loans Property Investor

:max_bytes(150000):strip_icc()/sofi-d3a06fcea0664f459ca369be9d67f0ba.png)

Best Online Personal Loans Of September 2022

5 Personal Loan Requirements And How To Qualify Forbes Advisor Forbes Advisor

Where To Get Small Personal Loans Of 3 000 Or Less Student Loan Hero

Need A Personal Loan Here S How To Find Loans And Apply